New Tax Brackets 2026 – Experts share projections of 2026 tax brackets if the tax cuts and jobs act expires. Calculate your personal tax rate based on your adjusted gross income for the 2024 tax year. The current cap of $750,000 for new mortgages will revert to $1,000,000. For a single taxpayer, the rates are:

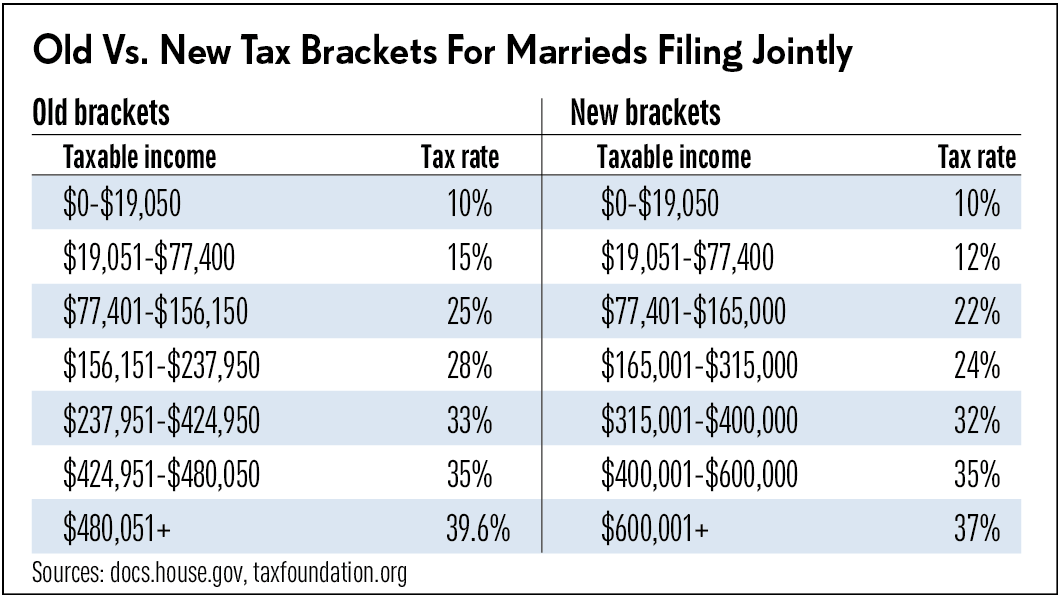

According to the tax foundation, this is what the changes may look like. The tax cuts and jobs act lowered the overall tax rates for most individuals and adjusted income tax brackets. You pay the higher rate only on the part that's in the new tax bracket. 2026 federal income tax brackets.

New Tax Brackets 2026

New Tax Brackets 2026

There is broad bipartisan support to extend about three. Here you will find federal income tax rates and brackets for tax years 2025, 2026, and 2027. The tcja created new, lower tax rates and increased the income thresholds before each new marginal tax bracket applied.

2024 tax rates for a single taxpayer. When the tcja expires, new 2026 tax brackets will rise for many. See current federal tax brackets and rates based on your income and filing status.

The tax year 2025 adjustments described below generally apply to income tax returns to be filed starting tax season 2026. Allowing businesses to write off more investments partially alleviates a bias in the tax code. If congress allows the tax cuts and jobs act (tcja) to expire as scheduled, most aspects of the individual income tax would undergo substantial changes, resulting in more than 62 percent of tax filers experiencing tax increases in 2026.

Tax rate on taxable income from. For example, in 2017, the marginal tax brackets were 10%, 15%, 25%, 28%, 33%. The tax items for tax year 2025 of greatest interest to many taxpayers include the following dollar amounts:

Shifting Retirement Assets From TaxDeferred To TaxNow By 2026

Start Planning Now For A Higher Tax Environment Pay Taxes Later

Tax Rates Sunset in 2026 and Why That Matters Modern Wealth Management

Tax Calculator How the TCJA Expiration Will Affect You

T200030 Number of Tax Units by Tax Bracket and Filing Status, 2026 Tax Policy Center

![]()

TCJA Why Your Taxes Are Likely to Increase in 2026 and What to Do About It Boldin

11 Big Tax Changes on the Horizon Northwestern Mutual

Planning for Your Taxes in 2018 part 1 Tax Reform for Individuals Isler CPA

Video Link In Bio Tax Free Blueprint. 2025 tax brackets apply to taxes due in 2026. In the U.S., federal tax is progressive. The tax rate you pay increases as your

Tax Rates Sunset in 2026 and Why That Matters Modern Wealth Management

Taxpayers Can Expect Changes as Key Tax Provisions Sunset

2024 Tax Brackets IRS Makes Inflation Adjustments Modern Wealth Management

2025 Tax Brackets Announced What's Different?

Navigating the 2025 Tax Sunset Key Insights You Need to Know Alaska Wealth Advisors

Planning for Personal Tax Laws Changing in 2026 Mercer Advisors

Leave a Reply

You must be logged in to post a comment.